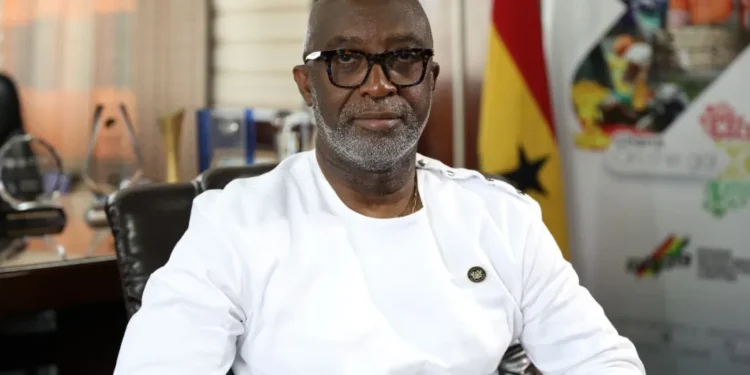

Amidst news of his company, Ghana Investment Promotions Centre nearing collapse, Chief Executive Officer (CEO), Reginald Yofi Grant, has made some propositions on how he believes Ghana and Africa as a whole, can make use of their natural resources to rise into good economic standing and become investment-worthy again.

This comes following news that the GIPC is financially strained as investors are no longer interested in making investments in the country due to the economic situation.

Yofi believes that African countries have the potential to become a major player in global industrialization and markets if they effectively monetize and add value to the continent’s abundant natural resources.

Speaking at this year’s Canada-Ghana Chamber of Commerce (CANCHAM) CEO’s Connect, Mr. Grant expressed that the issue of unemployment and lack of jobs for the youth is one that should be almost non-existent in Africa because the larger percentage of raw minerals like gold, platinum, chromium and oil are exported from African countries and making good use of these resources is our ticket out of the persistent economic hardship and unemployment.

He also contended that Africa, as the main producer of high demand commodities such as corn, shea butter, cashew, soy beans, coffee, etc., must leverage it’s ability to influence pricing on the stock market, and this can only be achieved with the implementation of policies that control, by way of reducing exports.

“Africa spectacularly, remains the most intriguing continent in the world because it has all the raw materials, and in the production world you expect that the raw materials would drive industrialization; but we rather export the raw resources and import finished goods onto the continent”, he said.

Yofi challenged African governments to take initiatives to reduce export of raw materials and commodities and instead, focus on building industries that process and add more value to these materials.

That way, Africa can call the shots on the global market with regards to pricing, as African countries will grow from being mere exporters of raw materials to producers of finished goods, hence, scraping the need to spend more money buying back the processed goods/products from the countries that raw materials are exported to, and in turn, there would also be more industrial jobs created for the youth.

“We have not optimized our assets by monetizing them. It is time for Africa to rethink its approach to natural resource management and adopt strategies prioritizing value addition, industrialization and domestic benefaction. By doing so, the continent can unlock the true potential of its natural resources and create the wealth that benefits all Africans”.

Other invited guests at the CANCHAM CEO’s Connect agreed with Yofi’s suggestions and included that that to successfully create these transformative paths for Africa’s economy and global market stance leveraging natural resources, government, private sector players and civil society organizations will have to work collaboratively; investing in infrastructure, promoting policy coherence and building capacity for value addition and industrialization.

The growing economic hardship in Ghana and Africa in general, has left Yofi Grant’s GIPC financially strained as its traditional revenue sources, which is mainly providing services such as processing work permits, providing investment data, issuing registration certificates, etc. to foreign investors have dried up.

GIPC, according to reports, saw a 50% drop in investments between 2022 and 2023. They also noted a 16% increase in inbound investments in the first quarter of 2024 compared to the same period in 2023, however, for the second quarter of 2024, the agency reported generating no income from these sources.

The company is now in dire need of financial support to maintain its operations, as their main revenue which is investors, seem to be packing their bags due to the nation’s current fiscal crisis. The GIPC, therefore, has resorted to seeking taxpayer funding, arguing that that Ghanaians get a lot of value from its existence and should pay for the full privilege.