A survey by auditing and accounting firm, KPMG has revealed the John Mahama government will lose GH¢6.4 billion if the E-levy and Covid tax is scrapped tomorrow in the 2025 budget reading.

“KPMG notes that abolishing the E-levy and Covid-19 levy could result in a revenue shortfall of at least GH¢6.4 billion”.

“Beyond the revenue measures proposed by respondents, the government should also leverage technology to enhance property rate administration and collection, as well as review taxation within the digital and e-commerce sectors.

Additionally, strengthening public financial management systems, closing loopholes in public procurement, and reducing wasteful spending are critical to improving fiscal sustainability”, KPMG stated.

However, Felix Kwakye Ofosu, the Minister of State for Government Communications has revealed the John Mahama government is on course to scrap E-Levy, COVID Levy in the 2025 budget.

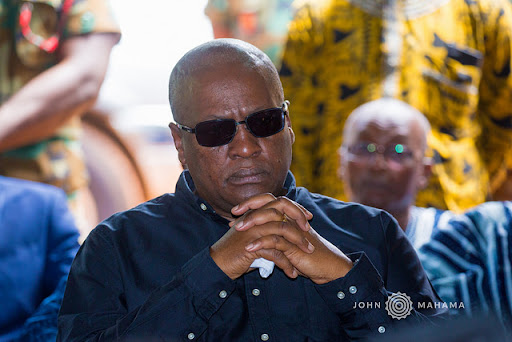

John Mahama’s 120-day Social Contract listed the removal of the E-Levy, the COVID levy, a 10% tax on bet winnings, and the emissions levy all within the administration’s first 90 days in government.

Speaking to journalists in Accra on Monday, Kwakye Ofosu stated, “The finance minister has clearly indicated that we are on course to meeting those promises. So when on Tuesday he unveils the details of his budget, you will find that we have kept faith with the people of Ghana regarding the specific promises we made in the 120-day social contract,” Ofosu stated.

Addressing concerns about the Ghana Cedi depreciation, he added, “In terms of the currency, the finance minister will highlight measures both within the long term and medium term to address the financial weaknesses within our economy, one of which is rapid currency depreciation.

“In concert with development partners and other stakeholders within the economy, appropriate measures will be prescribed for addressing this perennial challenge of currency depreciation”, he emphasised.

Meanwhile, Thomas Nyarko Ampem, the Deputy Minister of Finance has detailed that John Mahama’s government will scrap the e-levy and betting tax.

According to Thomas Nyarko Ampem, the e-levy and betting tax would be scrapped in line with the NDC’s campaign promises.

Thomas Nyarko Ampem has assured that the cancellation would be seen in the 2025 budget to be read on March 11.

Speaking in an interview on Channel One TV on Monday, March 3, 2025, the Deputy Finance Minister detailed, “The President has made it clear that he will deliver on the promises he made to Ghanaians. That includes removing the e-levy and betting tax”.

“The medium-term revenue strategy estimates that we have a 61% VAT gap, meaning we are collecting only 39% of our potential VAT revenue. By improving tax collection, we can make up for the revenue shortfall from removing these levies”, he added.

Both the e-levy and betting tax faced strong public opposition, with many in particular arguing the e-levy placed an extra burden on low-income earners and hindered digital operations.

The e-levy was introduced in 2022, initially charged 1.5 per cent and was later reduced to 1 per cent, with the betting tax being introduced in 2023 which took 10 per cent betting wins.

The now finance minister Dr Cassiel Ato Forson during his vetting stated that in his first budget as Finance Minister, he would abolish the betting tax and the e-levy.

According to Ato Forson, the betting tax and e-levy have failed to achieve their purpose.

Appearing before the Appointments Committee of Parliament on Monday, January 13, Dr Forson stated, “I insist that the betting tax must be abolished, and as Finance Minister, I will abolish it in my first budget because it has failed,”

“My position on the e-levy is well known. I have written articles about it, and my position has not changed,” he stated.

See the post below:

Government to lose GH¢6.4bn if it scraps E-levy, Covid-19 – KPMG survey

Details here; https://t.co/1BY7G21xdf#JoyNews || #MyJoyOnline pic.twitter.com/2MfERwhGB5

— JoyNews (@JoyNewsOnTV) March 10, 2025