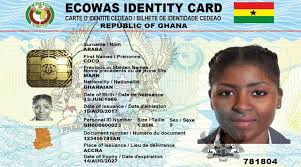

The Bank of Ghana (BoG) has issued a firm directive against photocopying Ghana Cards for banking transactions, emphasizing that biometric verification must be the standard for identity authentication.

According to BoG, photocopying Ghana Cards for customer verification is not an acceptable practice.

The directive, which aligns with the National Identity Register Regulations, 2012 (L.I. 2111), underscores the growing risks associated with outdated verification methods such as lookup lists and visual inspections.

Deputy Head of Office under the Financial Integrity Office of BoG, Mr. Ashitei Trebi-Ollennu during a stakeholder engagement in Accra, organized by Identity Management Systems II (IMS II) Ltd. in collaboration with the National Identification Authority (NIA) disclosed that BoG never authorized banks to photocopy Ghana cards.

“We have never said that banks should photocopy Ghana Cards. Photocopying leaves room for fraud and compromises the integrity of transactions” he said.

He emphasized that banks must verify identities directly through the biometric verification system linked to the National Identification database to ensure a secure and reliable financial ecosystem.

The event, themed “Protect Every Transaction with Biometric Verification,” brought together the Bank of Ghana, the Ghana Association of Banks, the National Identification Authority, and representatives from the 25 universal banks in Ghana to discuss the critical role of identity verification in securing financial transactions.

The engagement aimed to create a productive dialogue between the Bank of Ghana, Association of Banks, National Identification Authority and representatives of all universal banks.

Banks provided valuable feedback on how the exchange of information can be enhanced to streamline verification processes and improve efficiency.

The National Identification Authority, on the other hand, re-echoed its legal mandate.

NIA’s Head-Legal Directorate, Teresa Eson-Benjamin, said the law establishes the Ghana Card as the sole form of identification for banking transactions.

This clarification is crucial in ensuring that all financial institutions fully align with the legal framework governing identity verification in the country.

The discussions focused on biometric verification’s importance as the most secure form of authentication.

The event called for financial institutions to fully transition to biometric-based verification, ensuring that the domestic financial sector remains robust, fraud-proof and aligned with international best practices.